#65- The next 24 months for early stage investing

I have borrowed heavily from Sam Lessin to provide an Indian context to readers. You can read his original post here.

Venture capital is the supplier to public investors. Public investors demand and value a product, late stage venture investors deliver the product to them, and the early stage venture finds what the late stage wants, with all of them earning a certain return.

What are return expectations?

Public investors want to earn 12-14% IRRs over long periods of time with low uncertainty. They make good money if 1-2 out of 10 bets fail/underperform.

Late stage investors want to earn 18-24% IRRs over long periods and are ready to accept a slightly higher level of uncertainty than public investors to earn that extra return. They make good money if 3-4 out of 10 bets fail.

Early stage investors want to earn 25%+ over their fund lifecycles and are ready to accept a very high level of uncertainty (significantly higher than public, and higher than late stage). They make good money even if 8-9 out of 10 bets fail.

Public investors: Drying demand

However, the public investor demand for the products the late stage investors have been peddling them has dried up because:

Big picture shift - inflation, increasing rates to battle it, staring at recession & consequent flight to safety tolerating lower uncertainty

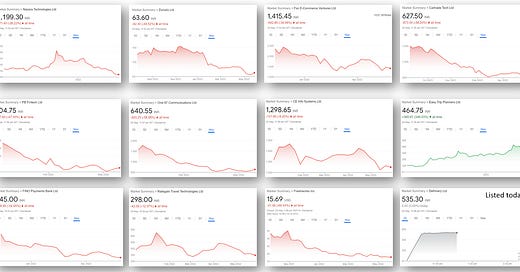

Bad products - Most of the products sold to public investors by late stage investors have turned out to be duds. The public investor is pissed off at being sold bad products now that the covid froth has cleared [see charts below]

Many IPOs in the last two years have been companies with weak fundamentals, being peddled as mature companies in their respective ecosystems, commanding astronomical valuations. Many late stage investors have made a lot of money with low judgement, wanting to pay to play at any cost, showing who has the bigger package - but the party is now over.

Late stage: Dead inventory

Late stage investors are now stuck with dead inventory of startups on their books which is overpriced and they can not sell. Or they paid high prices to buy, but will see their ownership diluted because the companies need more cash from other investors to rework their existence. New capital is being more diligent, opening books of target companies, and seeing many being cooked.

Early stage: Course correction

Early stage investors are sitting on a lot of money (approx. USD 2 bn from Micro VC to Series A funds raised in the last 12 mos, being raised as we speak) and because they invest at low prices, mark downs will not dent their returns much. But for newer investments they do not know what to buy today at what price which late stage investors will be comfortable paying tomorrow.

What happens next in early stage?

Great companies will still be funded, but with a pause as early stage investors frantically try to figure out what price will the late stage investors be willing to pay tomorrow

Back to basics by funding core, and ‘real’ businesses. Fewer leaps of faith or moon shot hopes as the margin of safety is narrow and nobody to catch you if you fall

No expensive deals for mediocre products or ideas. At the right price, every asset is AAA. Higher chances of making 100x returns from entry valuations of 100 cr vs 1000 cr irrespective of macro scenario if underlying asset is strong

If you like what you read, please consider sharing with people you think will benefit from this-

If you really like what you read, please consider subscribing!