#110- GLP-1- Miracle or Mirage?

From weight loss to GDP growth what can be GLP-1’s unexpected impact

What is GLP-1 and why is everyone talking about it?

Glucagon-like peptide-1 (GLP-1) is a hormone our body already produces. It is released in the gut after eating. It tells the pancreas to release insulin. It tells the brain to slow down hunger. Normally, this system regulates weight. But in obesity, it fails.

When GLP-1 levels are low, hunger signals are high. The brain fights weight loss, and treats it like starvation. This is why "eat less, move more" fails. The body pushes back.

GLP-1 drugs do the following-

Increase insulin production

Reduce blood sugar

Slow down digestion

Reduce appetite

What are GLP-1 drugs used for?

Type 2 diabetes

Weight loss

Other health conditions (like risk of heart disease, kidney disease, stroke, fatty liver disease)

Examples of GLP-1 drugs

Ozempic, Wegovy, Mounjaro, etc

and people are talking about it….

What makes GLP-1 drugs so different?

Weight loss drugs are not new. Most work the same way. They suppress appetite or increase metabolism. Amphetamines raise heart rate. Xenical blocks fat absorption. A Bupropion messes with brain chemistry. Almost all have issues-

side effects

weak results

weight regain

GLP-1 drugs do not just suppress cravings. They restore the body’s natural weight control. Hunger fades without the body thinking it is starving. This is not how past drugs worked. Those fought the body. These work with it.

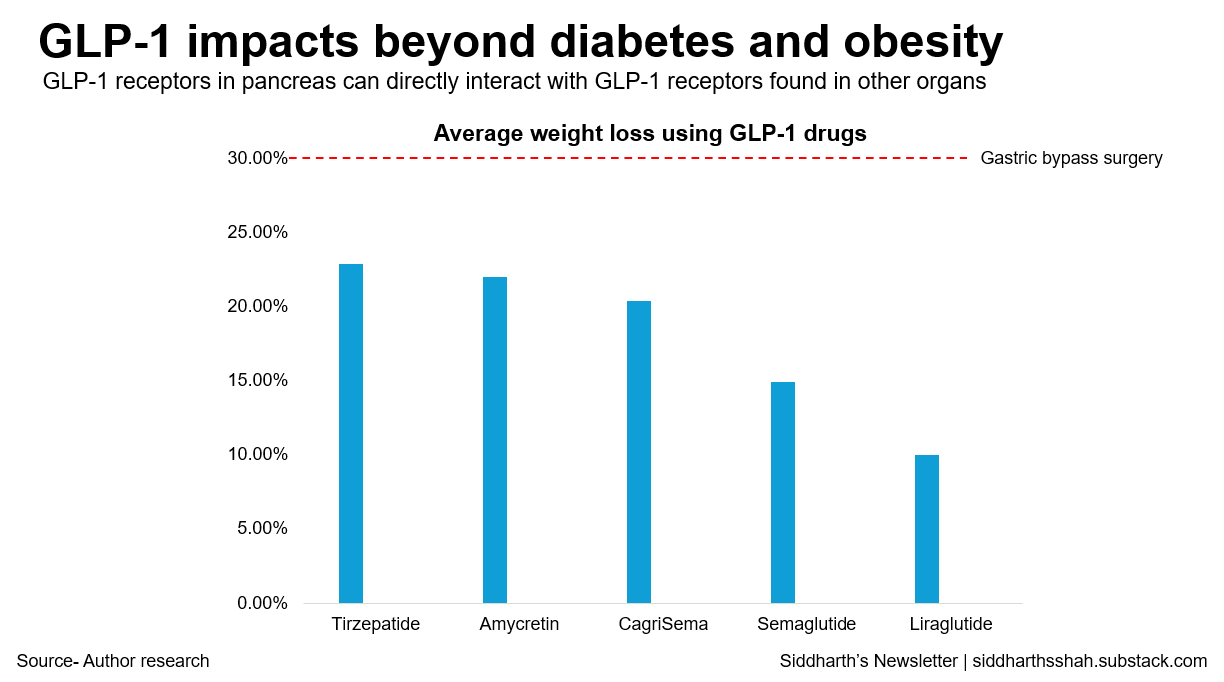

The numbers show the difference. Old drugs? Single-digit weight loss. Some better than others. Phentermine-topiramate was 10%. Bupropion-naltrexone was 5%.

But GLP-1s? Semaglutide (Wegovy), 14.9%. Tirzepatide (Mounjaro), 22.5%. That is bariatric surgery-level weight loss. Without surgery. Just one injection a week.

Of course, we have seen weight-loss hype before. Big excitement. Big adoption. Then the problems appear. Is this the same? Maybe. Many drugs have failed. But this feels different. The mechanism makes sense. The data seems strong. And these drugs have been used for diabetes for over a decade so safety is well understood. If this holds, it is not just a new drug. It is a new way to think about obesity. Not willpower. Not discipline. A medical condition. Treatable like any other!

The economic impact of GLP-1 drugs

These drugs aren't just about weight loss. They're about economics, insurance, and how healthcare costs shape entire industries. So, what happens if this market really takes off. Goldman Sachs has projected a $100bn number for these drugs like it’s inevitable. It’s not. Markets don’t grow in straight lines. Things get in the way like pricing, regulation, supply constraints, unexpected side effects. But let’s assume for a second that this plays out. What’s actually changing? Because if this market really grows 10x in a decade, it’s not just about pharma making more money. Something fundamental has to shift.

$100bn but how?

What gets us from today’s ~$10bn to Goldman Sachs' projected $100bn? The math is non linear, looks simple, but the drivers matter-

More people taking GLP-1s- GLP-1 users in USA could rise to 15mn by 2030 if insurance expands and supply issues clear up

More use cases- These drugs might work for more than obesity. Clinical trials are testing them for heart disease, sleep apnea, liver disease, even addiction. Every new approval expands the market

Better insurance coverage- Right now, many plans don’t cover GLP-1s for obesity. Medicare is patchy. If full coverage happens, adoption explodes

Cheaper formulations- GLP-1s are injections, which limits who will take them. Oral versions are in development, and if they work, that’s a game changer. Pills are cheaper to make, easier to take, and more likely to get broad insurance coverage. Additionally, Semaglutide is going off patent from 2026 in regions like Brazil, and India which can explode indigenous manufacturing and the innovations that come with it

None of these are guaranteed. But if they materialize, the jump to $100bn is plausible. And that number isn’t just about pharma. It means millions of people taking these drugs long-term. That has consequences.

Will we see impact on productivity?

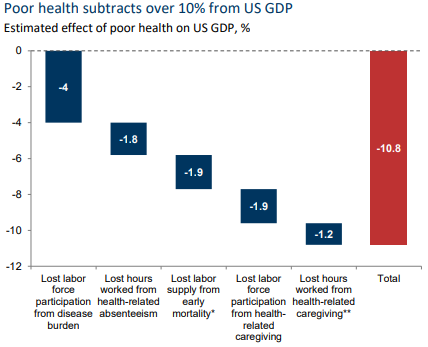

Obesity leeches the economy. It leads to increasing healthcare costs, reduces worker participation times, and decreases productivity. Obese people are more likely to have diabetes, hypertension, joint issues, sleep problems- something we see around but choose to ignore everyday. That means more sick days, shorter careers, and higher medical spending. Some studies estimate that obesity cuts per-capita GDP by around 3%.

So what happens if GLP-1s start reversing that? Goldman Sachs ran the numbers: if 30mn Americans take these drugs, GDP could rise by 0.4%. If 70mn do, GDP could rise by over 1%. That’s not even remotely small. A 1% increase in US GDP is ~$280bn, which is more than the GDPs of 130 out of the 177 countries as in Worldometer.

But the real question is who captures that value. Employers? Insurers? The government? If companies pay for GLP-1s, do they see the return through lower healthcare costs and higher productivity? If Medicare covers them, does it save money on treating obesity-related diseases? Or does this just drive up healthcare spending with unclear long-term savings? That’s the uncertainty.

Constraints aplenty

GLP-1s are expensive as usage can run up to $15k/year. Most people can’t afford that. Some can, but most can not. With US GDP per capita at $80k, spending 20% of pre-tax income on weight loss forever? Unrealistic. Insurance will decide access. Medicare does not cover all of them for obesity.

Private insurers make patients go through hoops- try other treatments first, prove they failed, hit a BMI threshold, or have a co-morbidity like high blood pressure, diabetes. Even then, it maybe denied. Employers are divided. Some cover, some don’t, all worry about cost and whether it’s a sunk investment Hard to say.

Supply is another issue. Novo Nordisk had to pause Wegovy’s U.S. launch. Couldn’t make enough. Demand outstripped production. These drugs are hard to manufacture. Not just the drug itself but the delivery systems. Autoinjectors. Specialized supply chains. Ramping up production takes years. You can’t just build a factory overnight. If supply is tight, adoption slows. If adoption slows, market growth slows. It’s all connected.

Which industries will feel it?

The pharma sector wins, obviously. But the spillover effects could reshape entire industries-

F&B- These drugs suppress appetite. People eat less. That means lower demand for processed snacks, fast food, carbonated beverages

Consumer (beauty, retail)- Weight loss changes buying habits. People update their wardrobes. They spend differently on beauty, fitness, travel- more hikes than movies

Airlines- Passenger weight affects fuel costs. If enough people lose weight, airline margins improve. Some carriers are reportedly modeling this into long-term cost projections

Healthcare- Fewer cases of obesity-related conditions could mean lower demand for bariatric surgery, diabetes drugs, sleep apnea treatments, not even talking about the general obesity induced cardiovascular diseases or injuries and rehab. But more people living longer could increase demand for other healthcare services. It’s unclear where this nets out

Is this a one time thing vs a structural thing?

Say GLP-1 adoption grows, the market hits $100bn, and the economic benefits start materializing. What then? Do we just declare victory over obesity? Probably not.

Scenario A- GLP-1s become a standard treatment, like statins for cholesterol. They don’t eliminate obesity, but they control it, preventing the worst effects. In that case, this is a permanent shift in healthcare and economic productivity.

Scenario B- this is just the start. Better versions of GLP-1s emerge which are more effective, cheaper, easier to take. Maybe AI-driven drug discovery accelerates this further, leading to treatments that fundamentally solve metabolic dysfunction. If that happens, we’re talking about a structural shift in public health.

And that’s the real question. Is this just a lucrative new category of medication? Or the first step in something much bigger? Right now, no one knows. But how this plays out will shape healthcare and the economy for decades.

So where does that leave us? GLP-1s work. They are costly. Insurance is inconsistent. Supply is tight. None of these are small problems. The question isn’t whether GLP-1s will be big. They already are. The question is how quickly these barriers fall. And in what order. A lot of questions to be answered tomorrow. All exciting for the future of humanity nonetheless.