Bengaluru's 2024 water crisis exposed a critical flaw, non-revenue water (NRW).

The water utilities could not keep up with demand because of its decaying infrastructure, inherent topographical issues and rapid on-going urbanization.

This crisis made the problem of Non-Revenue Water (NRW) apparent, showing how much water was wasted in the system. Cities like Bengaluru, and many others around the world, are facing the same issue. It is clear that the need for better leak detection and NRW reduction solutions is now more important than ever.

Non-Revenue Water: The hidden crisis in urban water supply

Non-Revenue Water (NRW), the water lost in distribution networks that does not make utilities any money. This water loss & therefore, revenue loss, also makes water more expensive for consumers and affects utilities’ profitability. NRW, which is the gap between water supplied and billed, is very important for measuring the health of utilities. If not fixed, it hurts both their financial health and service quality.

The underlying inefficiencies and its impact on utilities

NRW often shows poor management. At the same time, the data utilities use is usually incorrect or incomplete. Bad indicators and lack of transparency hide the real magnitude of the problem.

Strain on utilities- The financial impact is profound. Lost water means lost revenue, reducing utilities’ ability to invest in infrastructure improvements and leaving systems more vulnerable to failure. As operational costs rise without matching revenue, utilities find themselves trapped in a vicious cycle of declining financial health.

Strain on consumers- This inefficiency directly burdens consumers. Utilities must recover their costs, often leading to higher water tariffs. In areas where affordability is already a challenge, this creates a growing disparity in access to clean water, further straining the social fabric.

Strain on environment- The environmental consequences are equally severe. Water wasted due to leaks or inefficiencies depletes scarce resources, intensifying stress on already fragile ecosystems. When utilities lose water, they don’t just lose revenue, they also increase energy consumption and greenhouse gas emissions from pumping and treating excess water that never reaches consumers.

Despite the clear benefits of addressing NRW, progress in many developing regions remains slow. The technical complexity, upfront costs, and delayed financial returns often deter action. Without strong leadership and strategic investment, the inefficiencies persist, amplifying financial strain, consumer costs, and environmental degradation. While some Asian utilities have made progress, widespread adoption of these best practices is still lacking, leaving many systems ill-equipped to meet growing urban demands.

NRW in India

NRW is a big problem in India, with national average stuck around 38% and cities like Kolkata and Bangalore even worse, up to 50%. The problem comes from leaks in old pipes, illegal connections, faulty meters, and poor maintenance.

Lucknow Municipal Corporation (LMC) conducted a study with Ceinsys Tech to understand NRW levels and losses in the city. The study showed that the city loses 55% of total water as non-revenue water loss, amounting to 64% value losses in rupee terms of its total annual expenses. The below table shows that LMC loses approximately ₹ 650mn per year due to NRW.

As utilities try to grow their networks and fix these issues simultaneously, technology like smart meters, leak detectors, and real-time monitoring become essential. The plan to lower NRW is clear, but it will take time to fix the technical, financial, and legal challenges that in the way.

Key trends in the Indian water sector

India’s water sector is undergoing many changes. There is a strong push by government to solve water shortage and to make water use more efficient and sustainable. Policies, technology, and new infrastructure are creating many chances for growth in this space.

Jal Jeevan Mission- The aim of this program is to bring tap water to every rural home by 2024. It will work with communities and use rainwater harvesting and other methods. The program wants to give safe drinking water, which will help improve health and rural life. JJM is allocated ₹ 3.6 lac crores.

AMRUT 2.0- This is about improving water supply and managing waste water in cities. It also promotes saving water, cleaning rivers, and recycling water. It aim to make cities "water secure" The program also aims on reduction of non-revenue water (NRW), which means less water loss, and better urban planning for the future. AMRUT is armed with ₹2.99 lac crores to improve urban water supply.

Smart Cities Mission- This mission focuses on making cities better for people. It includes action items like smart water meters, real-time IoT systems, and recycling of water. It will help cities use water more wisely and make it fair for everyone. The goal is improving life in cities with simple but powerful ideas like tracking water and reducing waste.

NRW in Asia

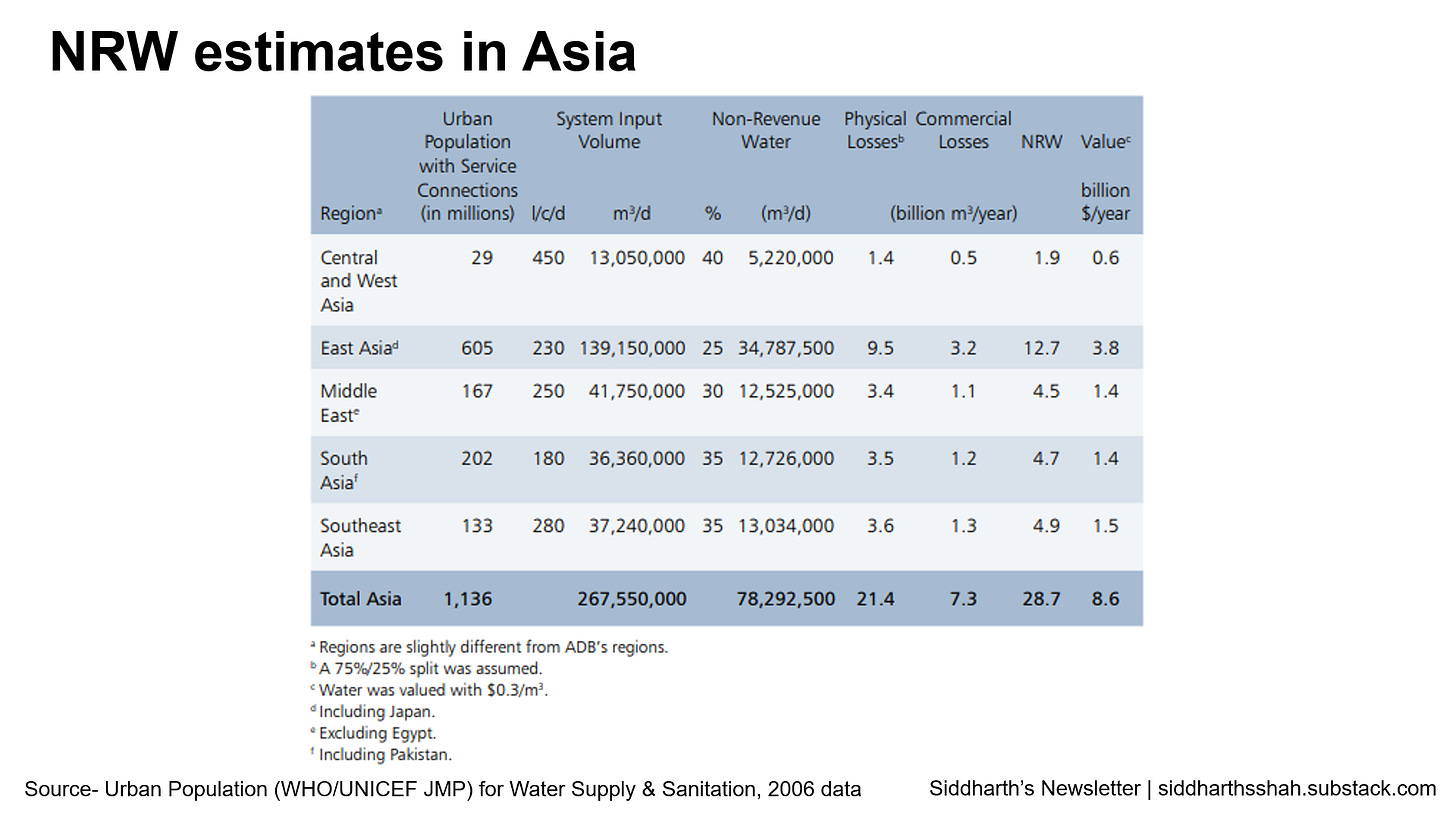

Water utilities in Asia face a huge challenge with NRW). On average, utilities lose 30% of daily water production due to inefficiency, with some countries even losing up to 65%. This is not just a practical problem, it’s a financial one. Water lost is money wasted!

For years, governments thought the way to fix this was to make more water, build more treatment plants, or expand infrastructure like dams. But this just makes things worse, because more water goes into broken, badly maintained systems. The solution is not more supply, but fixing the system’s inefficiencies like better distribution, metering, and maintenance. If governments focus on improving old systems and managing water better, they can cut down the losses and create a more efficient, sustainable system.

The Philippines

In the Philippines, safe water is still a major issue. The Philippine Development Plan (2017-2022) says 14.5% of people about 22.7 million families do not have a reliable water supply. Many of these people live in poor provinces or urban areas, with 332 municipalities still without water.

Indonesia

Indonesia has set big goals for its water sector in the National Medium Term Development Plan 2020-2024. By 2024, 30% of households were to have piped water and 90% to have better sanitation. The government plans to add 10 million new water connections and improve networks.

Singapore

Singapore is at a key point, as it faces the end of its water agreement in 2061. The country is focusing on being a global leader in water innovation, with strong investments in research and development led by Public Utilities Board (PUB). PUB is rolling out some 300,000 smart water meters under the first phase of its Smart Water Meter Programme.

Thailand

Thailand has a non-revenue water rate of about 35%, with serious challenges in its northern and northeastern areas, which are often hit by drought. Like most water utilities operating in the megacities of Southeast Asia, Metropolitan Waterworks Authority (MWA) has been struggling for years to cope with demand from a fast-growing population.

Market landscape

Water tech market is mix of old and new solutions. Major tech areas are hydraulic models, metering, leak detection, data analytics, sensors, and data control systems. These are tools to help utilities know how water moves, where is leaking, and how much is used. Old pipes and bad input data make the job hard for utilities, so they need better tech to find and fix problems fast. Companies here focus on products like smart meters, IoT sensors, or software to track water flow.

Leak detection is big focus area for tech now. Many startups use IoT & AI to help utilities find leaks faster. But it is not only about finding leaks; fixing them is more important. Some companies are combining data analytics with sensors to give utilities real-time help to fix pipes and manage pressure.

On the ground side, there are engineering design consultants who plan how to build systems and check pipelines. Leak detection consultants are also important as they find where system is wasting water, but they don’t usually repair it.

EPCs (Engineering, Procurement, Construction) companies are key players for building water networks and running operations. They handle big projects for water supply construction and also do O&M (operations and maintenance). These companies have strong role because they know how to build infrastructure, but they are at times slower to adopt new tech.

Overall, there is a big opportunity for companies who can combine tech like sensors, AI, and control systems into one simple product. Utilities want easy solutions that fix many problems, not too many tools. Future is in mix of tech, good design, and on-ground execution.

Key trends and opportunities

Technology Adoption

Smart meters, IoT devices, and AI tools are already changing how utilities manage water networks. Tech is no longer optional, it is integral. These technologies help in monitor water flow, find leaks, and give real-time data to take quick action. Data analytics is also very important because it give clear insights to improve operations. But standalone tools often don’t solve the problem in its entirety. An integrated system where all parts talk to each other is what utilities really need. It save time, reduces confusion, and make it easier to manage water networks in big cities and rural areas.

Business Models that Work

Utilities in many countries struggle with big upfront costs, and they anyway do not have huge budgets. Low-capex SaaS models work better because they let utilities start small and scale as and when needed. This model also reduces risk for utilities because they pay-per-use, not at once. Another good model to test out is performance-based services. Startups get paid only when they reduce NRW. It completely aligns interests of the utility and startup, so both work together for same result. Public-private partnerships (PPP) are also very useful. Governments need private sector help to modernize water systems, and companies can offer flexible solutions at lower cost.

Emerging Markets Focus

Emerging markets like India, Southeast Asia, and MENA have very different challenges. Many regions have old systems, not enough capital, and rapid urbanization. Also, water supply is intermittent, so tools must work even when water supply doesn’t. But these markets also have big opportunities because the demand is growing fast. Companies that can design solutions for these unique problems can scale quickly. It is about adapting technology and models to local needs, not just copying what works in other places.

As VC investing in deep tech with a core focus on B2B, I most excited by these four models:

SaaS Platform for Leak Management- Company makes subscription software. It helps utilities monitor leaks, run predictive maintenance, and use real-time data. These integrate sensor, GIS maps, hydraulic model, and machine learning. SaaS lets utilities adopt new systems affordably. These are recurring revenue, easier to scale with smaller clientele to begin with, and learn with more and more data. This can be a global product.

Performance based leak detection as a service- Company install leak systems, get paid when they reduce NRW. Utilities pay based on result of saving water, not just product. Tying pay to real results creates trust and align goals with utility. Utility not need to pay big cost at start. It’s low risk for utility but high value if works well.

Water OS- This is more than software. It gives sensors, leak detection tools, and consulting. All combined to improve utility’s water system fully. I think of these as digital twins of the water network. Utilities need total solutions, not piecemeal ones. This model builds long-term partner relations, harder for customers to switch. This is a huge market with government and city level contracts.

Data platform- Utility pays subscription for data analysis from sensors and AI. Reports on NRW, water flow, leaks, and usage help them decide better without own analytics team, effectively using the platform for better, informed decisions. Data is the new gold and oil. This model offers easy use insights, lets utility focus on execution and not analysis. Customers start relying heavily on it once they start seeing results.

These models excite me because they solve big problems with clear business proposition. They focus on scale, sustainability, and operational impact, which is what water sector needs now.

For startups, water sector is big opportunity ripe for disruption. Simple, integrated scalable solutions with clear ROI will win. And for investors, water is no longer a basic need or resource, it is multi- billion dollar market for new ideas to grow.

Hi Siddharth,

I recently came across your Twitter profile and got interested seeing your thoughts. I subscribed to your blog also, and today's post is really good to read. It's very informative the way you have brought out the message. I would like to keep in touch.

Also, in case you find any interesting opportunity which is not a very early startup but has some decent track record and you would like to share to explore it together, I would love to take part.

Thanks,

Ayush

Screener.in