#76- Winning Middle India by Bala Srinivasa & T.N. Hari

Notes, insights, and learnings from the story of India's new-age entrepreneurs

I have limited experience in the consumer internet space. The size of the opportunity in India is alluring, but my limited experience makes me jittery about making long-term bets. So when I read that Bala from Arkam is writing a book on Middle India, I pre-ordered the copy in an instant. As a family office, we speak and evaluate multiple LP investments. Few investors walk the talk with respect to their investment thesis and Arkam is one of them. Having also interacted with their team it becomes more evident. Today, I share my views after reading Bala & T.N.’s book along with a small cache of charts and graphs I keep updating from time to time to beef up my understanding of the India opportunity and become investment ready.

This book is for you if:

You’re long on India

You’re a founder looking to build & solve for Middle India

You’re an investor looking to firm up your thesis on Indian consumer internet

You’re an employee looking to work with companies solving for India

You’re a marketing enthusiast looking to shore up your knowledge bank

The India Opportunity

What is Middle India?

Why is Middle India underserved?

Middle India is fragmented across smaller towns & low price points which fail to offset the high costs of physical operations

Indian SMBs which offer appropriate goods & services do not have the low-cost means to acquire customers efficiently

Innovation directed toward solving for the top 100 million consumers of India pales in comparison to the massive existential problems that limit the availability of affordable, effective and essential services for the next 500 million Indians just below the top of the pyramid

But the tides are turning

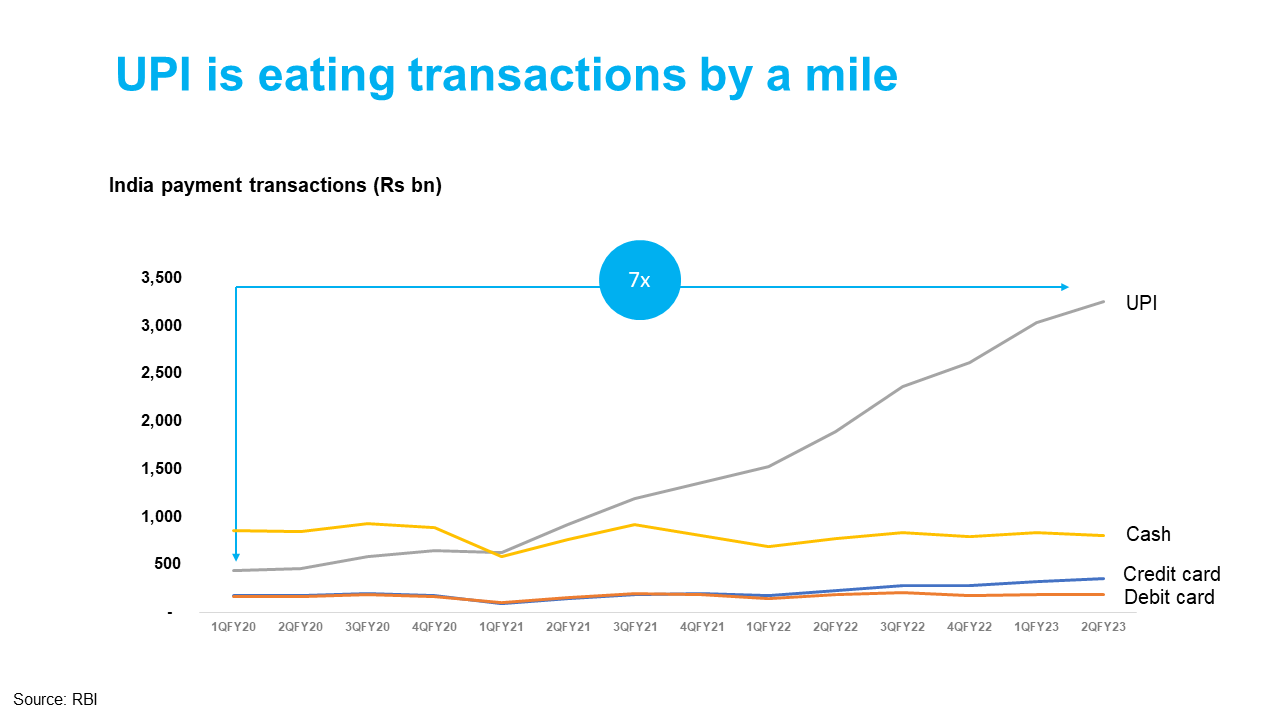

UPI easing & eating transactions

In a country where more than 90% of transactions happen in cash and a similar % of grocery purchases happen via physical transactions at Kirana stores, the first wave of COVID-19 was seismic in terms of forcing behaviour change by necessity…

Jio + COVID-19 induced user growth

Senior citizens in India (stuck in another town with little to no support during Covid) learnt how to order on BigBasket, Amazon, Flipkart

They also learnt how to use video consultations to connect with their doctors

Found the ease of use of UPI- based digital payments to pay electricity & phone bills

According to KPMG, the age group 55 years and above accounted for only 6-8% of internet users. During 2020, this segment was one of the fastest-growing groups with 25-30% growth across categories like medicines, communication, commerce, and entertainment

According to PhonePe, half of its new users during the pandemic were completely new to digital payments and from non-millenial older groups

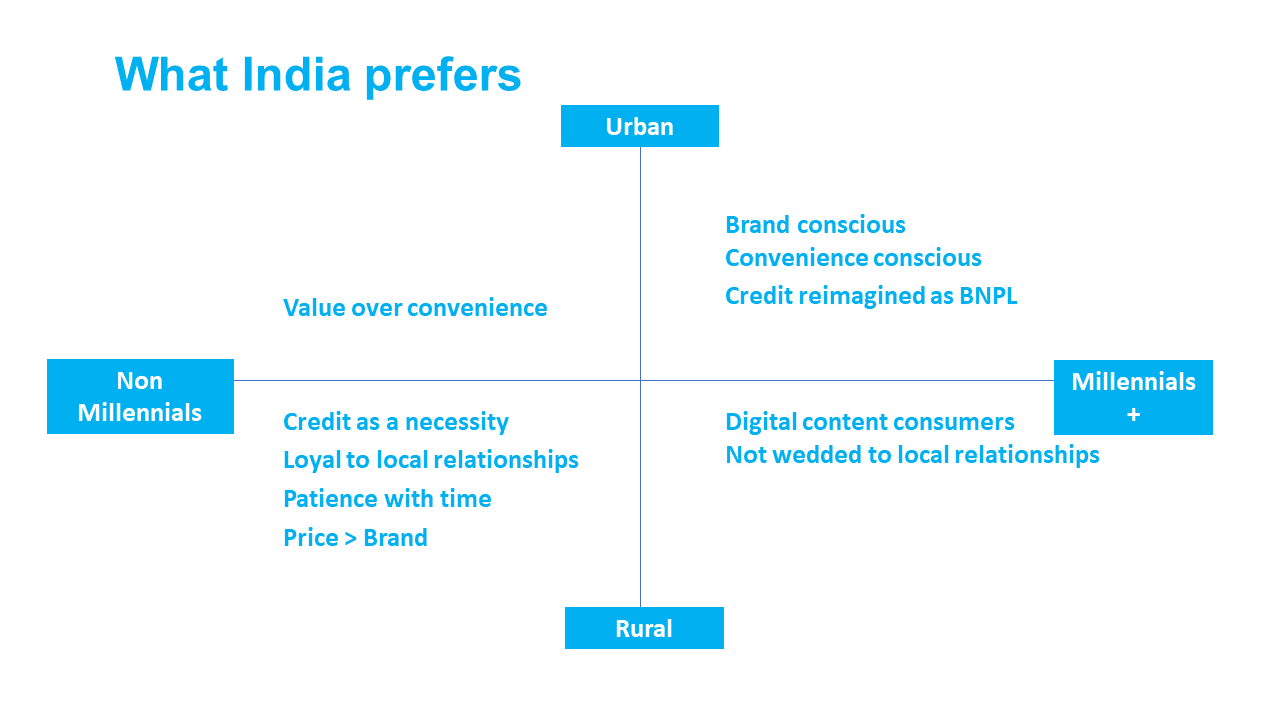

India’s demographic nuances

The sheer distributed size

Over a billion Indians live in cities, towns, and villages with less than 1 million in population

Over a billion Indians are over the age of 12 years

India’s market potential value (MPV) in top 25 cities

This is a numerical score based on means, awareness, consumption, and market support. This helps us understand the ease of selling into a market. Indexed against Mumbai at 1000, it shows how metros like Bangalore & Chennai are only 40% of Mumbai’s MPV.

Which market do you think first-time founders building for Middle India should target first?

Serving Middle India

C.K. Prahalad in his book ‘Fortune at the Bottom of the Pyramid’ said the bottom of the pyramid has 4 billion people with annual per capita income of $1500 making it a $6tn (trillion!) wallet-size opportunity.

His daughter, Deepa Prahalad, gave this thesis a new life in ‘The new fortune at the bottom of the pyramid’ saying despite the allure, the magnanimous task often fell onto governments or non-profits because most businesses lack the insight & cost structures to reach poor consumers.

Critics of C.K. Prahalad’s book argued that the poor would be better off if companies and governments saw them as producers and entrepreneurs rather than consumers.

The deeper issue?

The majority of market conundrums are between ‘high margin - low volume’ offerings and ‘low margin - high volume’ ones. But the peculiarity of the Indian market makes it a ‘low margin - low volume’ & niche play which poses a challenge to building a sustainable business. The bottom of the pyramid is a highly fragmented, geographically scattered market further separated by cultural and language barriers.

The 500 million-strong middle India with $4-25k in family income is again a fairly attractive market but difficult to tap into because it isn’t homogenous. It is split across small towns, large metros, mid-size cities towns and rural India.

Fun fact: HDFC Bank limits itself to 40 million banking customers because it makes little sense to go out and acquire hundreds of millions of customers when they’re widely dispersed, making it unviable. It limits service to the top of the pyramid whereas SBI serves almost 450 million customers.

For India to come to age, a 2-prong approach is required:

Augment incomes to expand consumption

Develop profitable products & services valued by a diverse set of price-point-conscious customers

The result?

The birth of companies like UrbanCompany, Ola, Swiggy, Zomato, and Uber not only served the high-income segment but also provided employment & upskilling opportunities to people in the lower & lower middle-income segment.

Youth from rural India had been joining these platforms in large numbers. Many migrated to the nearest city or town to sign up for driving lessons or vocational training by paying a fee. These platforms now offer many upskilling opportunities for free. Zomato, Swiggy, and TripAdvisor increased the discoverability of small tourist destinations and restaurants.

All these services existed - plumbing, eating out, and taxis were not new. But the industrialization and standardization of these services allowed effortless consumption to de-bottleneck market forces.

How to succeed in Middle India

Middle India consumer segmentation is crucial to product design

Winning customer trust is key to wallet share

Razorpay won trust by providing useful content to SMBs in the payments & banking space. Smartstaff provided visibility of income, payout time frames, shift schedules, and pension funds. Middle India has low trust in a new interface.

Customers do not trade risk for potential upside

Kirana store owners will pledge their entire wealth and borrow money to open a store with an investment of 2-3 lacs. But they will not stock a new noodles brand with a 25-30% margin over Maggi with a 5% margin due to inventory risk. Instead, they’ll ask for return guarantees.

Daily/weekly transacting frequency as opposed to monthly/annually

Middle India earns between 3-8 lacs per annum and thinks of consumption in short cycles. It will not lock up excess cash in any purchases which take a long time to utilize. Examples: Foodgrains, hygiene, health, consumer goods, etc.

Krazybee provided simple & fast small ticket loans via their mobile platform to help Middle India solve their cash flow issues. Smartstaff convinced employees to turn to weekly payouts to tackle attrition and absenteeism.

Low-cost acquisition and high retention are crucial to winning

Middle India AOVs and transaction values are small which can cause a drain on resources if CAC is not controlled. Krazybee has a CAC of Rs 300-500 much lower than BFSI CAC of Rs 5000-7000. It built distribution access to 1000+ colleges for its student loans and became a clear leader in the space. Notwithstanding, it has a repeat rate of 80%.

Vaishali Verma (CEO of Initiative Media) says Middle India is not a single monolith but many Indias within, with a heterogeneity of demographics, lifestyles, behaviour, etc. Fast scaling starting find themselves trying to run Rs 20-100 cr pan India campaigns without an understanding of the above.

Enable low-cost onboarding & low cost to serve

Razorpay had such a simple product usage sequence that even a small business in a tier 3 town could be up and running with their website or store payments platform in a few clicks.

PayTM’s sound box is an example of a constrained environment which enabled loud voice confirmation when a payment was made. More than the trust factor, the device removed the friction in a crowded Kirana store of constantly checking mobile screens for payment confirmation.

Work towards a multi-product platform strategy

Because of low margin low volume niche phenomena coupled with challenges of distribution, it is near impossible for companies in Middle India to be single product companies. The cost of creating, distributing and serving will often be more than the customer spending.

Here, trust and goodwill earned from the first product are very important benchmarks for a company to launch its second, and third innings. A leaky bucket or high CAC are never good places to expand.

Team & Strategy trumps product

A company serving Middle India needs a team attuned to its needs and the challenges of rolling out solutions with continuous feedback loops. Many teams talk about Middle India from their comfortable air-conditioned offices in metro cities.

Successful companies find a balance between traditional tech talent and hands-on Middle India experience. At mid-to-senior levels, candidates are closely evaluated for their ability to work in the field.

Closing thoughts

India is still in v1 of its consumer internet story. We’ve seen magnanimous business models emerge but ones operating profitably at scale are rare. Firming up the understanding of Middle India which doubles as both the consumer and the enabler of services is imperative. This book is a fascinating read providing a very nuanced view of how alluring yet difficult Middle India is to service.

This is a must-read for consumer internet companies trying to build for India, especially Middle India. Am positive the book will be cited for many TAM and GTM slides going forward.