Dear Founders, Learn From My Experience

Dr Aniruddha Malpani has been an angel investor for a long time now. And as he looks back and reflects, he believes there have been quite a few learnings along the way.

Having worked very closely with Dr. Malpani for about a year now, I derive a lot of my learnings from him. And as someone who rates his investments not by the ROI or the Return on Investment, but by LOI or the Learning on Investment, it is only apt I share his learnings with founders and investors and hope they can also learn from his experience.

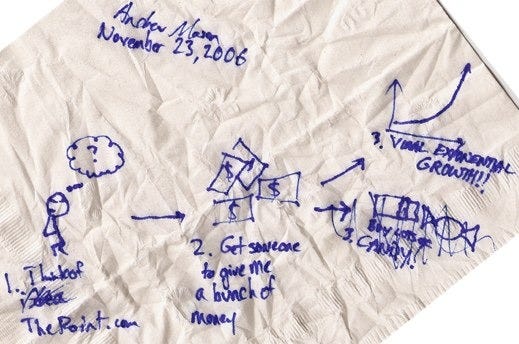

It only happens in movies

In the initial days, being an angel feels like a romantic fantasy - where you will write cheques to founders based on their vision, while sitting over coffee at a quaint shop, looking at a business model and strategy scribbled over the back of a paper napkin thinking you've discovered the next Google! With time, you understand that this is not only naive but also foolish. It only happens in movies. There are no violins, or eureka moments. Any founder who has interacted with an investor understands this quickly.

It’s the execution stupid!

Getting cool ideas is never enough. For the money lies in the execution. The idea of Google, if not implemented or executed would not have been worth a single penny today. And this is why we do not fuss so much about the ideas today. Yes, we admire and deeply respect creativity and innovation - but we understand that just those two things are neither sufficient nor necessary for the success of a startup. Moonshot ideas are fun to read about but extremely hard to pull off. We love simple ideas performed a million times consistently better than a half-assed moonshot!

Founder > Idea

It can be a mediocre idea, but a fantastic founder - and they can still make it big. But a fantastic idea coupled with a not so enterprising founder might not move the needle. It is the founder and not the idea that makes or breaks the company. If you can identify the right founders, you can increase the chances of success exponentially.

Good things take time

While we have become better and more organized over time, we know that evaluating an opportunity is a time-consuming and complicated exercise. In the past, we did pride ourselves on signing cheques quickly. But today, we are a bit more experienced than yesterday. We will say no quickly if it does not fit - candor is our greatest asset. At the same time, we will take our time before saying yes because we want to be on the same page with the founder and trust them.

Double or Nothing

We will double our bets when we think we have a winner. However, we will also pull the plugs on the loser and not continue investing in them.

Traction gets the Action

We have learned that the best way to reduce our risks is to ensure we invest in a company that has demonstrated traction. We look for companies that have paying customers, which means the product is (kind of) validated. We are no longer willing to fund just the idea, or the potential of it, we will only fund for scaling up!

Closing comments

The good thing is that the Indian startup ecosystem is still growing and there is room for many players to succeed. Everyone needs to identify their ideal role and stick to it. You can not be everything to everyone. Pick your best allies and work towards growth. For otherwise, you risk burning out due to unrealistic expectations!

If you like what you read, please consider subscribing below!