#16- Where does your competitive advantage come from?

Find out where your business model structurally deters competition - and is it a noteworthy deterrent?

This is the part-1 of a 2-part series on helping startups identify their structural advantage over the competition, and gauge whether the competitive advantage is strong enough to deter competition!

“What is your competitive advantage?”

“How are you better than others? Why?”

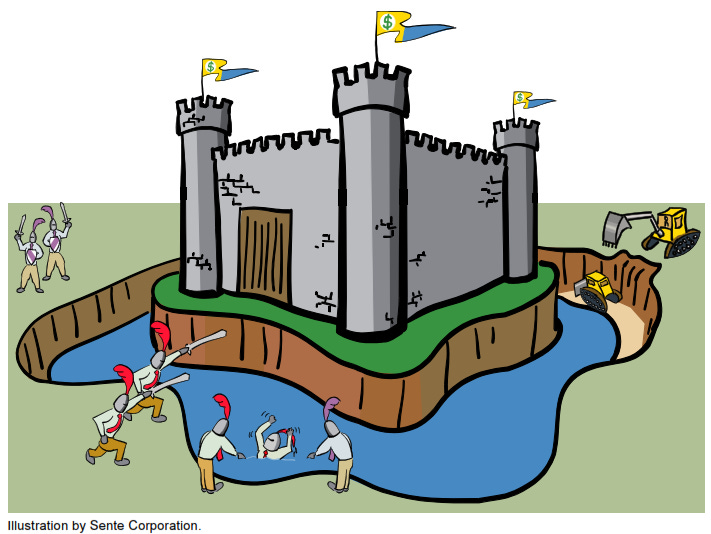

“What is your moat?”

This is a question founders have been asked umpteen number of times. Nobody knows what the right answer is - because there is no right answer. Some believe this question is routinely asked as a boilerplate checklist because, well it needs to be asked. Warren Buffet loves stocks that have a wide and sustainable “economic moat” - something uses to describe companies with a long-term competitive advantage.

Gee! Thanks Warren!

So what is your moat?

Where does your moat stem from?

Let’s find out the types so you can better answer this question and nail your investor meeting!

Moats are broadly in four categories:

State granted

Special knowledge

Scale

Systems

Now let us dig a little deeper into these!

What can State-Granted Moats comprise of?

State granted moat is conceptually the simplest form of entry barrier. Essentially the govt (whether directly or indirectly, protects a company from competition).

Favoritism

Favoritism arising out of govt policies like intellectual property, tariffs, regulation, licensing, standards, etc

Favoritism arising out of charters, legal monopolies, targetted support or championing state causes

Control of scarce resources

Ownership of land or materials

Special contracts with the state as a party

Typically any competitive advantage that arises out of state grants is viewed as weak and unsustainable. For eg- A legal-tech startup that has a license to procure e-stamp paper. This is not a strong moat, as over time the govt will open up the procedure and licensing and the industry will be flooded with startups who have the license!

Such advantages are a slave to bureaucracy, corruption, and quid-pro-quo which makes it a huge turn off for investors!

Additionally, most of these moats are transferable, thereby limits the creation of excess value!

One noteworthy exclusion is intellectual property - this, if it stems from great innovation leading to a patent - is invaluable!

What can Special Knowledge Moats comprise of?

You have knowledge that nobody else does, yet. This is an excellent way of preventing imitation. Prevention of imitation creates a lack of access to a resource thereby creating a better (think- wider and deeper) moat than the one above.

Closely held trade secrets

Tacit knowledge of experience, procedures, institutional memory, insights

This is a far better advantage to have that a state-granted one because it depends on exclusive access that ‘can’ be guarded and controlled. But is it really that much better?

Exclusivity only remains when you are able to enforce it. Knowledge is in people’s heads, people have the right to change employment and take the knowledge elsewhere, NDAs are hard to enforce, secret recipes (think KFC, Coca Cola) really seem like marketing gimmicks!

Tacit knowledge is a bit better because it can not be easily communicated or transferred. Afterall if I know how to fly an airplane, doesn’t mean I can easily teach others how to do so by just communication! Think of tacit knowledge as any field that says “its an art more than science”. But think about it, the same knowledge that makes it an art, and makes it more difficult to communicate; Is the same knowledge that makes it difficult to scale in a large organization! Scale comes from repetition.

For eg- A fitness startup whose founder is a thought-leader in fitness, and can make customized workout and diet plans for her clients! This is a special, tacit knowledge that comes from years of experience. But does that mean the same knowledge will be gained by everyone in the team? Highly unlikely. For the startup to scale, the founder’s bandwidth will be stretched!

This is a weak moat for startups, because despite the founder have some tacit knowledge from experience, if it is difficult to describe and communicate and repurpose as a solution to productify- it becomes less useful. This helps in a consulting field, not so much in the scale-hungry world of a startup.

So far we have learned that State-granted moats and Special knowledge moats are not very strong when it comes to deter competition or to scale! The limiting aspects of these moats render them not-so-useful for building scalable startups!

Stay tuned for part-2 of the series. In the next part, we will identify the remaining two moats - scale & systems, and find out whether they are strong enough for startups to remain competitive!

If you like what you read, please subscribe!

Post inspired by Jerry Neumann’s long-format article on his blog.