#51- How to determine the right sales model for your SAAS startup?

A common fallacy in the startup ecosystem is that SAAS startups get investor interest when they are able to self-service the sales channels. Many believe that only quick TAT, high volume, credit card-led, demo-free sales channels allow startups to scale globally. At the same enterprise-led sales oriented SAAS startups are treated like distant cousins.

While many businesses benefit from having a digital marketing-led lead generation which converts into product-led growth, we do not believe that this is the only way to grow. Applying a one-size-fits-all model for different businesses may be disastrous. Companies in the Malpani Ventures' stable have been able to grow to $1-3mn ARR business post seed stage on the back of an enterprise-led sales model.

But how can founders determine the right sales model for their SAAS startup? How should they consider key variables when they build a business plan or test the market or approach investors?

First principles tell us that the key metrics to track are - what is the ticket size, what does it cost to acquire the ticket, and how long does the cycle last?

How much are customers paying for the product?

Sales strategy should depend on what customers are paying for the product. Annual Contract Value or ACV is the key metric that founders need to track here. The strategy to deploy when your ACV is $100 or sub Rs. 10k is different from the strategy when your ACV is $100k or greater than Rs. 75 lacs.

Conventional wisdom tells us that the moment your ACV grows over $1k or inches towards Rs. 1 lac mark, founders may need to deploy a twin strategy that covers both inside sales and enterprise sales. Here is where things get a little different from the usual Silicon Valley modus operandi. A typical sales team member in the Western world costs approx. $100k in annual salary plus any bonuses or incentives, which means he/she needs to sell 100 of $1k ACV contracts, the higher the ACV, the better it is. However, if we operate India-led teams, as is the case with most of our portfolio companies, a sales team member costs approx. Rs. 20-25 lacs or $35k which means he/she breaks even sooner than their counterpart sitting in the West.

We typically see a trend where founders start selling themselves until they reach a Rs. 50 lac ARR, at which point they add a sales team which usually has a sales target of 2-2.5x their annual compensation, and keep adding members as soon as they are about to reach 2x productivity. This is possible due to the labour-cost arbitrage that we see in countries like India, Philippines, Indonesia etc. Do notice how we specify ACV and ARR at different times.

The range of ACVs from $5k to $50k is a space where startups should stick to an inside sales model of online demos, video calls, to convert. Once ACVs start hitting the $100k or Rs. 75 lac mark, startups need to invest in an enterprise sales team - to hit that expansion ARR, and grow accounts via a dedicated Accounts Executive.

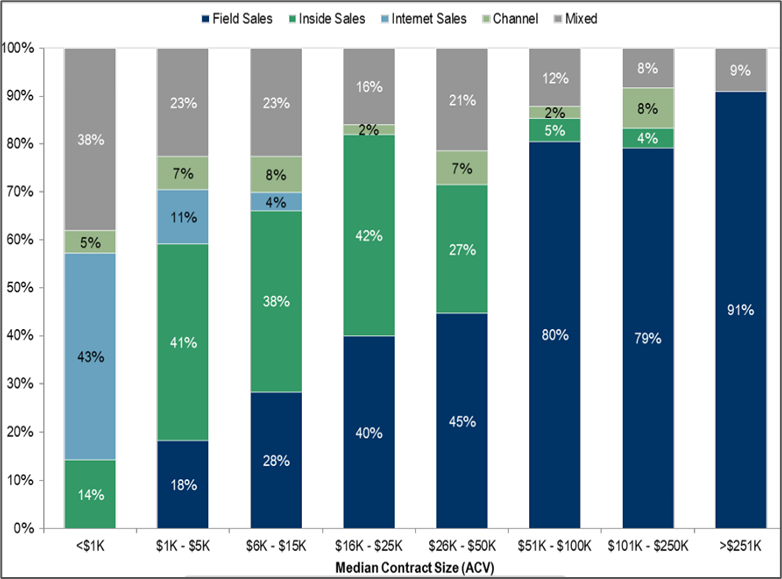

A 2017 Private SAAS company study by KBCM Technology Group indicates the self-service model of sales drops drastically as the ACVs grow more than $1k:

What does it cost to acquire a customer?

The cost of acquiring a customer (Customer Acquisition Cost or CAC) is key in determining which strategy to deploy. It boils down to simple unit economics. This is where Customer Lifetime Value or CLTV or LTV comes into the picture. When LTV is higher than CAC, you will make money. Higher the LTV/CAC ratio, more profitable is your business model.

However this method is not foolproof. This is simply because young startups have no idea what is their customer lifetime value. Most startups assume LTV based on churn numbers and make an educated guess. If the dollar amount of CAC is high, but the LTV/CAC ratio is also high, then it may seem that you have a profitable business, but it may also be the case that it will most likely take several years to recover the CAC while you are exposed to changing churn. Most investors look for CAC payback within 1 year.

Enterprise sales is a high CAC business model because of the upfront cost of having an enterprise sales team. An ACV of $200 with an 80% contribution margin means that a $100k sales team member needs to sell upwards of 600 contracts a year to payback his/her costs.

How long does the cycle last?

Self-service sales models don't typically work with a decision making system that involves multiple stakeholders, numerous demos, pilots, integrations, and approvals. We see many companies setting up a free-trial or short term subscription sales page on the website to convert users. But we see more than 3 out of 4 of these users being inactive, unqualified leads, which eventually churn out impacting the LTV assumptions. We see that a hands-off sales cycle does not work most of the time.

Customer success helps smoothen onboarding, convert free trials to paid subscriptions and is key to maintaining, growing LTV and increasing expansion ARRs. Most companies do not account for customer success costs in the CAC instead choose to charge one-time onboarding costs. We would rather include customer success as a part of CAC than increase the customer cash outflow considering success is not a one-time activity.

Which model should you select?

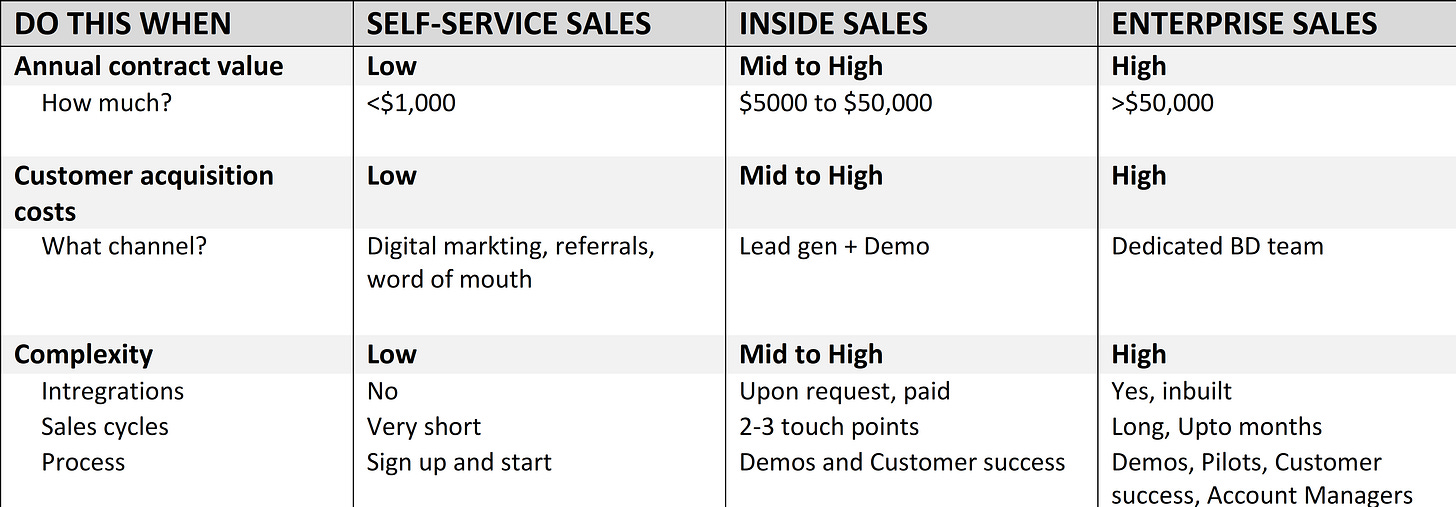

Selecting the most appropriate sales model depends on your ACV, your CAC, and the complexity of the sale. Typically higher ACV combined with high CAC often signal complex sales leading to an enterprise sales model. Very low ACVs can be acquired purely by digital marketing or word of mouth or referrals which require no-to-very low onboarding and only the presence of a customer onboarding or support team.

Here is a small chart which explains our thought process on which models to use, and when:

If you are building a fantastic SAAS startup which is looking for growth capital at the seed stage, please reach out to Siddharth for a call.

Read my other posts on enterprise sales

#8- How to conduct productive user interviews