#82- Saving grace

Returning investor capital when your business model fails to take off

There are a ton of startups which raised a lot of money in the last 3 years but failed to figure out their business models. Some startups have raised at very high valuations but now they face a predicament of either pivoting from leftover funds or raising at newer, lower valuations which is unpalatable to many. But what if there were another option which is painful yet graceful - returning investor capital and shutting down?

Scrolling through tech Twitter, I came across Gokul Rajaram’s tweet:

He makes a valid point. Many startup founders who raised substantial amounts of funding in 2020-21 are struggling to find product-market fit and are feeling torn between their commitment to stakeholders and the realization that they may be wasting time and money. This feeling is more acute for founders who have raised more money. Recently, a founder (from one of his investments) returned a significant amount of capital to investors, having realized that the company could not achieve its goals. Investors and founders need to be aware that there is a graceful way out and that chasing pivots endlessly is not a viable solution. The founder was able to find relief and support from their investors and employees, who understood the situation. Ultimately, founders need to make the right decision, and investors should have the courage to support them, even if it means accepting the return of capital.

I echo his views.

Ping was a social e-commerce marketplace connecting local entrepreneurs and home-based business owners with residents in housing societies. Born in the pandemic by giving a Shopify link to a farmer who got Rs 20K+ worth of orders in 8 hours, Ping amassed thousands of users without any marketing spend. It later raised seed capital from Elevation Capital. But soon, the growth stagnated and market behaviour reverted to mean. The founder took the tough decision of shutting down the business and it seems they have pivoted. I am not sure if they returned capital but they’ve definitely taken a hard pivot. The founder shared her story in a tweetstorm.

What is the story back home in India?

Seeds sown with cheap capital

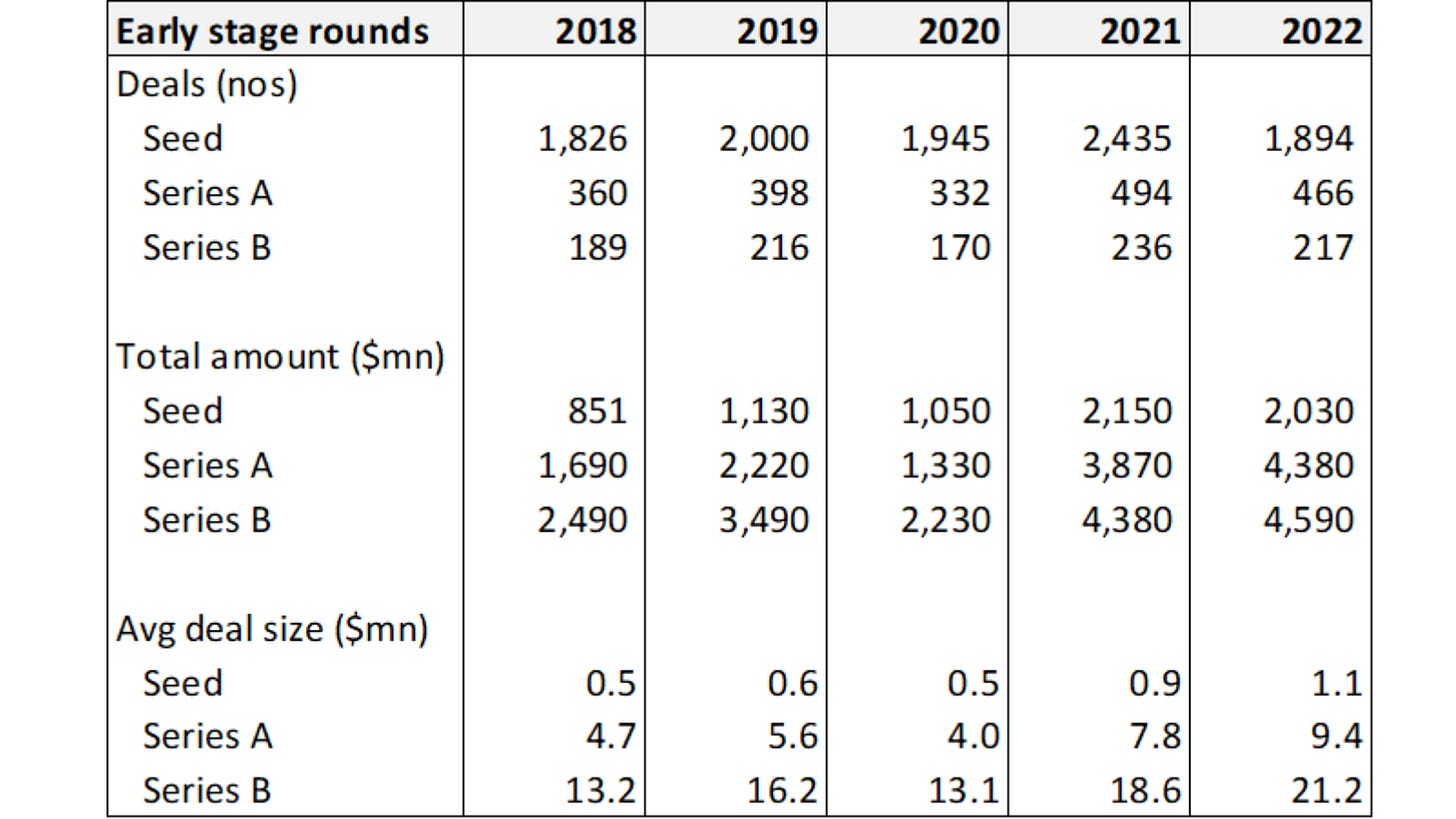

Indian startups, especially the early-stage ones (Angel, Pre-seed, Seed, Series A & Series B) raised a ton of money in 2021-2022. The average round size at seed stage more than doubled from just a little under $500k in 2018 to over $1.1mn in 2022. See below:

I am not sure if these numbers are exactly right (relying on the good graces of our friends at Tracxn), but early-stage Indian startups have raised more than $10bn in each of the last two years!

I dig deeper nonetheless… who are the top investors pouring in capital left, right, and center? Below is the list of the top 5 entities which have led the most number of deals in the last 5 years from 2018-2022, in each of the rounds (seed, series A and series B). Notice something?

Note- Axilor started as an incubator and later raised a fund in 2018.

The entities in red are incubators, accelerators, or angel investment platforms. And those in green are VC, micro VC, multi-stage VC, or PE funds.

The early stage landscape has changed and how? In 2018, VCs & platforms had a 50-50 split of deals with the top 5 lead investors having a total of 60 deals between them. But by 2022, platforms have completely taken over early-stage territory - the top 5 lead investors are now all platforms (or incubators, accelerators), and the deals between them have grown 5x (from 31 in 2018 to 154 in 2022)!

The more the merrier, until it is not

While this is certainly exciting for early-stage founders - there are more investors in the market, giving you more money at higher valuations, it can also be a double-edged sword. On one hand, a large influx of capital can help fuel growth and expansion. On the other hand, it can also create a lot of pressure to deliver results quickly, especially when it comes to product market fit.

Unfortunately, not every startup is able to figure out its business model or build the right product, even with large amounts of funding. As a result, many companies find themselves struggling to generate revenues, and unable to raise another round of funding due to high valuations. This can create a lot of stress for early-stage founders, who feel beholden to their investors and employees to keep building, pivoting, and doing anything to live up to their perceived commitment to their stakeholders.

Time to face the reality

Gokul writes:

The founder told me that the reason they ultimately decided to return the money stemmed from a convo with me several weeks ago, when they told me about their latest pivot, and I told them I’m supportive “as long as their heart is truly in it”. That phrase stuck with them, they introspected and ultimately realized their heart was not in it.

I’ve had such conversations in the past year too.

One company which started off as something, pivoted to B2C because investors in the funding boom insisted that’s where the future is. Almost $1mn raised since on that consumer story with burn rates of over $50k a month at times and no sight of the growth and revenues coming in, the company is in trouble, and those investors are nowhere to be found. I’ve flown to their city just to ask them to consider shutting a portion of the business down - but there is & was reluctance because that’s the only piece of business which an incoming investor is still most likely to pay for. The company is in constant burn control and expense reduction, has had multiple conversations with potential acquirers who almost always backed out, and is now looking at a 6-month runway with a very difficult reality to face.

Can you imagine being let down and onto the wrong path by people who you thought would lead you to success?

Another company started off as an unvalidated idea but the founders lacked business development capabilities. Again almost $1mn was raised to find ways to monetize and sustain burn, but after numerous pivots, the company is looking at a very short runway left. With no further infusion coming in, it’s most likely to shut shop.

Many founders believe they will have failed as entrepreneurs and leaders if they do not give it their all until their last breath, last penny, and last try. It is partly the investors’ responsibility to let their founders know it’s okay to throw in the towel. Multiple pivots, continuously working under deadlines, low runway, low salaries, and deteriorating employee morale is never easy. Should the founders lose their sense of passion and purpose, they should know that they have the option to shut down and move on. This does not tarnish their reputation - we’re all humans.

Talking to friends who’ve worked at some Series A/B startups, I hear stories of founders losing their temper at the smallest of things because of investor pressure to show performance. But deep down they & their team know that they don’t have that hero product which customers are willing to pay for.

“All of it is just a fancy marketing exercise to sell something nobody wants, we all know it”

-A batchmate at a Series A company who is contemplating to quit

A ton of capital chased startups causing more founders to raise more than the average cheque size. However, raising more capital did not convert into validating the business model and inching towards product market fit. The result? Many companies are staring at a bleak future. The only difference is that some are still well-capitalized, while others don’t have any cash left.

Way out

But what if there was a graceful way out? What if early-stage founders in India could return investor capital and close down their startups without feeling like they had failed? We have precedence.

GoZoomo

GoZoomo was a 2-year-old used-car marketplace having raised $7mn from investors like Elevation Partners (erstwhile SAIF Partners). In 2016, the founders decided to shut down and return capital (approx half of the capital raised) to investors. Despite several iterations, the founders realized that unit economics will never make sense, and looking at the data they took the tough call to shut it down. All the employees got seven weeks of pay as severance and help with landing other jobs.

“The right thing to do is to treat the capital respectfully and deploy it where there is a better chance to create huge value. We tried to build a fast-scaleable business, but realized that the business model does not work. So it is better that this capital gets deployed elsewhere instead of us hoarding it and hoping that something good happens.”

GoZoomo CEO and co-founder Arnav Kumar told Tech in Asia.

Earning respect & credibility

“The startup journey is very, very hard. The entrepreneur takes a lot of risk and puts his life at stake by picking up entrepreneurship. During that stage, he is fighting all kinds of odds to survive and win. So it takes a lot of emotional and intellectual maturity on the part of the founder to take a decision like this. “This is probably the first time an entrepreneur is announcing this kind of a decision. Typically, when something is failing, an entrepreneur would try to show that his company is being acquired, while internally the story might be totally different. But these guys are sharing a lot of things in a transparent manner and taking this mature decision of returning money.”

Alok Goel, MD of Saif Partners.

Proton

In Jan 2022, Protonn shut down and returned capital to its investors. Protonn was a software to help freelancers build an online business in minutes. It raised $9m from a clutch of investors like Matrix Partners, 021 Capital, Binny Bansal, Kunal Shah etc. The company could not find the right product-market fit and the founders did not agree to pivot its business model.

Udayy

In June 2022, edtech startup Udayy shut down and returned $8.5mn to its investors. In a post-pandemic world when students returned to classrooms, Udayy found CACs were at an all-time high, retention was low, and parents gave feedback that their children were tired of zoom meetings. By then they already have several failed pivots in a span of 6-8 months. So despite having several months of runway left, they took a call to shut Udayy. The founders did not want to burn investors' and LPs’ hard-earned money nor did they want to waste teams’ time on a business which they knew was doomed to fail. They refunded customers, provided severance to employees, and helped them find other jobs, before returning capital. You can read co-founder Mahak’s post on LinkedIn sharing her perspective on the decision.

Making up your mind

As a founder you have the following options:

How can you do it?

I asked my friends from Treelife Consulting about the process of returning investor capital. I’ve worked with Jitesh & his team on quite a few deals and have come to respect their professionalism and promptness.

Priya from Treelife writes:

“Startups in India are typically set up as companies. Repayment of investor money from companies is not as easy compared to structures like LLPs. Commonly adopted methods for returning capital to shareholders in India are listed below :

Buyback of shares

The company can buyback the shares held by the investors. However, there are certain company law conditions for a buyback such as -

Company can only buyback its own shares out of (i) free reserves (ii) securities premium account or (iii) proceeds of the issue of any securities

Maximum amount that can be paid via buyback is 25% of paid-up capital + free reserves

Debt equity ratio cannot exceed 2:1 post-buy-back

Company cannot issue the same kind of shares for a period of 6 months (except bonus/discharge of subsisting obligations)

Company cannot do another buy-back for a period of 1 year

Company to pay buyback distribution tax on the ‘distributed income’ @ 23.296%. Proceeds received by shareholders on buyback are exempt from tax.

Capital reduction

The company can opt for a reduction of the paid-up capital of the shares held by the investors. However, the reduction of capital is undertaken through NCLT and is a time-consuming process which takes about 4 to 6 months.

While there are no tax implications for the company, proceeds received by investors are taxable as deemed dividend (at normal slab rates) to the extent of accumulated profits in the company and the balance is taxable as capital gains.

Liquidation

The company can opt for liquidation where the net assets (after paying off liabilities) can be distributed to all the shareholders. The Company will need to appoint a liquidator, who will dispose off the assets, pay off the liabilities, and the net available cash will be distributed to the shareholders. This process is also time-consuming and usually takes about 3 to 5 months.

Tax implications are the same as mentioned above for capital reduction.

Promoter buyout

Promoters can buy out the investor’s shareholding. Gains, if any, arising on the sale of shares are taxable as capital gains for investors.Dividends

If the company has profits, it may declare dividends to shareholders. Company to deduct TDS @ 10% while paying dividends. Dividends received by shareholders are taxable at normal slab rates as may be applicable.

It is pertinent to note that the above is assuming that the investors are resident Indians. In the case of non-resident investors, the tax implications will vary based on factors such as their legal status, country of incorporation, tax treaty with India, etc.”

As you understand this process of returning capital to investors is neither simple nor quick. It is painful and requires all stakeholders to be on board, have board approvals in place, and sometimes even investor consent because capital structure items are reserved matters - but herein lies the effort and commitment to do the right thing which the right investors will appreciate.

Conclusion

The journey of a founder is not an easy one, many deal with imposter syndrome and raising a large amount of money can add even more pressure to the already difficult path. It is crucial for founders to remember that chasing endless pivots to find product-market fit is not a sustainable solution, and there is a graceful way out if their heart is not in it.

As investors, we must have the grace and courage to support founders in making this decision and prioritize their sanity and logic over short-term gains. Ultimately, building an enduring company requires a passionate and committed founder, and it is better to make the difficult decision to return invested capital than to continue down a path that will ultimately lead to failure.

As Gokul said, we’ll support you as long as your heart is truly in it. But if it is a hail mary, acknowledge the reality and consider your options.

Further reading

Shutting Down Your Business Gracefully - HBR

Procedure to close a private limited company - Vakilsearch

When to Shut Down a Startup - YC

Why Zen99 Shut Down (3-part series) - Tristan Zier

Really enjoyed 'Saving Grace'—a thoughtful, reflective piece that invites us to reconsider our core values and the moments that truly uplift us. The narrative reminds me how protecting our innovative ideas, through practices like patent filing and trademark registration, is as crucial as preserving our personal values. Thanks for sharing such an inspiring perspective!

Safeguard your innovative ideas with robust IP protection. Discover more on patent filing and trademark registration at brainiac.co.in