#67- BVPs 'The Rise of SaaS in India'

Learnings from Bessemer Venture Partners' note on India SaaS combined with my on ground experience in early stage India SaaS

Bessemer Venture Partners dropped a note on The Rise of SaaS in India. I share key learnings & illustrations from the note combined with my on ground experience in early stage India SaaS.

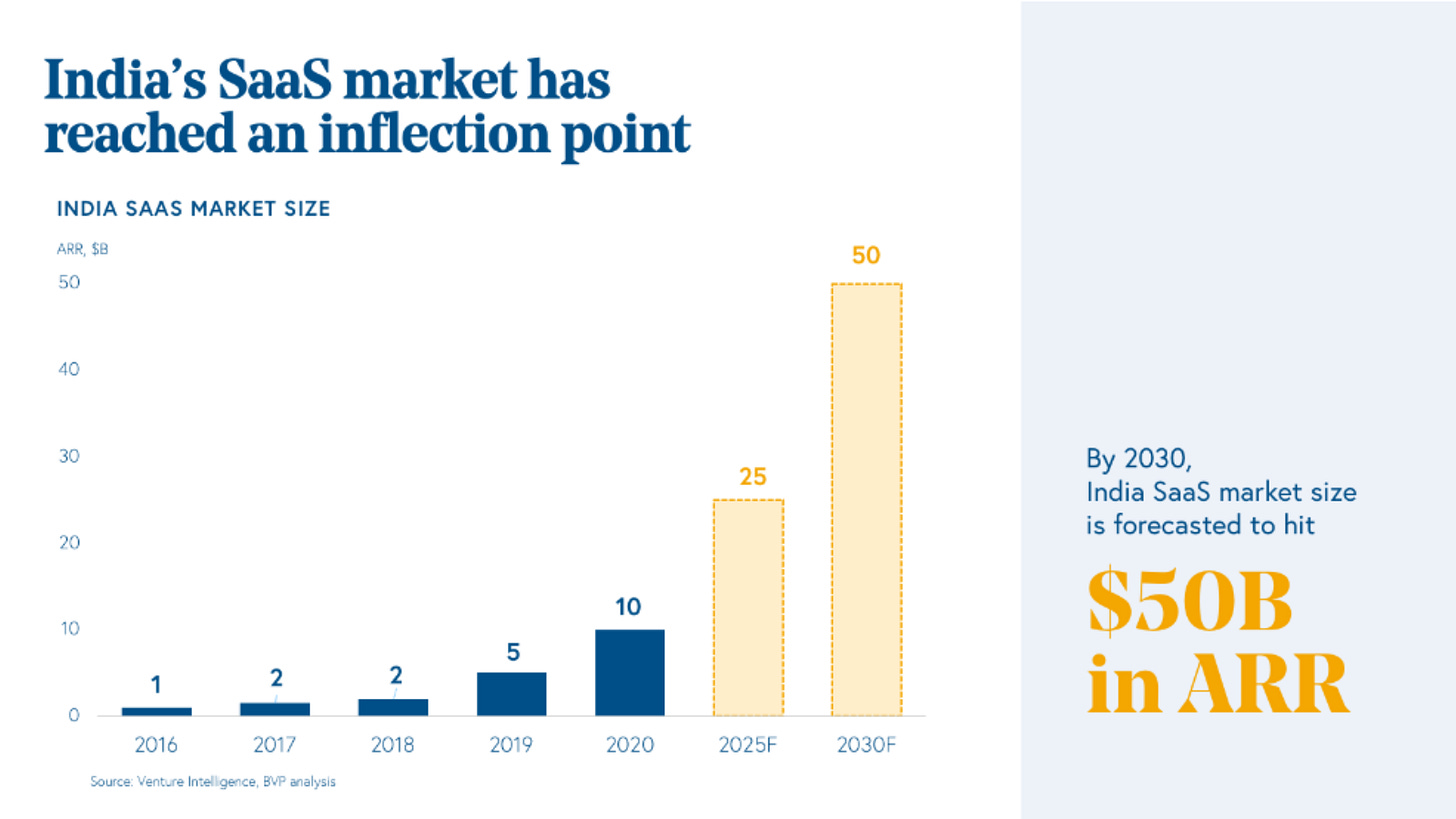

India SaaS at an inflection point

From $10B in ARR in 2020, India SaaS is expected to grow by:

20% CAGR from 2020 to 2025 and reach $25B in ARR

17% CAGR from 2020 to 2030 and reach $50B in ARR

India SaaS in its early days

Despite a tremendous amount of capital flowing into India SaaS, there are just about 70 SaaS companies in India which have crossed the $10M ARR mark.

This shows a long runway for growth in India SaaS, especially in early stage. Why?

India SaaS has approx. 1000 companies in the <$1M ARR1 with more and more companies entering the pipeline every day

Every investor will fight for the the same ~1000-odd companies keeping demand intact

Early stage deals will remain unaffected by the nuclear funding winter. However, expectations of valuations may rationalize2

India SaaS advantage

a. Capital efficiency

Indian SaaS companies are more efficient than their global counterparts. The chart below measures sales efficiency which is the amount of new revenue generated for every dollar invested in selling and promoting.

It shows us that India SaaS companies with:

~$10M in ARR generate $1.65 in revenue for every $1 spent on sales & marketing

~$25M in ARR generate $1.25 in revenue for every $1 spent on sales & marketing

$50-100M in ARR generate $0.85 in revenue for every $1 spent on sales & marketing

Compared to:

Global SaaS companies generating $0.35 for every $1 spent, and

BVP Global SaaS portfolio generating $0.55 for every $1 spent

Other highlights:

Global SaaS

Most best in class SaaS companies in the global SaaS market have approximately 70% sales efficiency at $10-$30 million ARR. As a business grows its revenue, efficiency drops to about 30-40% by the time the company reaches scale (e.g. $100 million ARR).

India SaaS

…most Indian SaaS companies run at 80 -100% or higher sales efficiency even when these businesses approach $100 million ARR. Best in class early stage Indian SaaS companies usually have 150%+ efficiency. This means most Indian SaaS companies will spend less than $100 million to get to $100 million in revenue. Across the number of businesses we’ve gotten to know in the region, the ability to break even at 10 million dollars of ARR is far more common. Leaders tend to raise capital only when the business is primed for hyper growth.

b. Multi-product strategy

SaaS businesses in India build products faster and much earlier in their lifecycle. A typical global SaaS company will focus on one product until it reaches $30-40M in ARR. But we see India SaaS belt out second and third products even before its first one crosses $5M in ARR. Mainstream examples of this are Zoho & Freshworks.

Examples in early stage include Creditas3 which started on Ethera. Referral hiring company RippleHire which has referral hiring & talent acquisition cloud as its listed products. A Bangalore based company has eCommerce personalization, optimization, and email marketing as its 3 products.

c. Personalized customer facing activities

Building in India for the world has cost-arbitrage which allows Indian companies to set up dedicated inside sales teams, personalized after sales support, and customer success. The outcome is happy (spoilt) customers, cross-selling opportunities, leading towards higher net dollar retention.

A trend we see is to hand hold global customers via the Done-For-You (DFY) customer success model for the first few weeks or months of onboarding a new customer. A dedicated customer success executive (CSE) follows up with, and hand holds customers for some time, helping them fully explore the product, proactively address queries, and increase usage. This helps avoid early churn, leading to longer life time value per customer. The low cost of an in-house CSE ($1000 per month) who can handle tens of clients makes it possible, which the West can not replicate without having on-ground teams in SEA or outsourcing.

Summarized by BVP: Achieving higher net dollar retention (NDR) leads to sustainable growth and higher value creation as customers are not only more engaged, but also increasing the amount they spend.

India SaaS framework to evaluate

The India SaaS team at Bessemer pays special attention to two metrics: Net Dollar Retention and Sales Efficiency. Best-in-class efficiency scores in India are above 150% and NDR can exceed 140%.

Key learning here is to leverage the cost arbitrage. Affordable talent in India means companies can provide personalized sales & customer success teams to its customers. Inside sales to enable high sales efficiency, and customer success to enable higher retention. Two other important aspects are a ~$1BN market, 60%+ gross margins.

India SaaS attracting global eyeballs

India SaaS companies are also attracting attention from global and local public market investors. In the last eight months, we’ve witnessed two IPOs coming from both the local and global market (e.g. Freshworks and RateGain, respectively) and a number of global strategic M&As.

India SaaS predictions

Rise of global category creators and leaders

Fintech for all

Enabling e-commerce

Productizing services

Digitization of healthcare

Of which I strongly believe in the following:

Fintech for all (non lending, service enablers)

Emergence of software products to support incumbent financial institutions like banks, insurance companies, asset managers to provide better service at lower cost across the country. Every step of financial service delivery will be reimagined by cloud software companies built on top of the digital financial rails of Aadhar e.g. products for easier KYC, authentication, underwriting, loan or insurance processing, credit monitoring, loan collections, insurance claims processing etc.

Enabling e-commerce (shovels in the gold rush)

New software solutions will emerge to ensure even the smallest business can go online and serve every single pincode in the city with the same level of efficiency and customer satisfaction that these multi-billion dollar marketplaces have made consumers expect.

Solutions enabling consumer companies (both Indian & global) grow revenues, streamline operations, and run on the cloud will be the winners

Productizing services (Think dal-chawal and not bread & butter)

India is a services heavy economy with massive fragmentation in supply, and will remain so. These services, particularly B2B services, will get productized as mobile internet penetration increases and as financial rails get standardized with ease of KYC and payments across vendors and customers. These software businesses could be pure software tools or software enabled marketplaces. Leaders in these businesses will use cloud software to organize the fragmented supply, standardize service delivery, increase transparency, and facilitate payments.

Connect with me

India SaaS is clearly on the rise, and I see no better space to be an early stage investor. If you are a founder, investor, or specialist in SaaS, believe in the rise of India SaaS, and would like to connect, please book a slot for a 30-min call.

Let’s create Centaurs!

Creditas is a Malpani Ventures portfolio company